This seems to be a common sentiment but im not following the logic here.

Consider the average user would pay much less. As our mint fees could be way down to 0.1% and continuous only brings it to 0.3% after holding a year, for example.

And the statement the price wouldnt be predictable is false. Any arbitrager could concisely tell you the value of renbtc (=btc times the continuous fee as a percent applied over time)

No the price argument is linked to right now 1btc = 1renBTC always. The continuous fee kills this and makes the user experience significantly worse. It would also make renBTC much less attractive for any of the current yield farming use cases (which are the only useful ones at the moment).

Network Stats to Consider

- Record New Node Growth as of 01.10.2021 - 172 Darknodes

- Impact of New Nodes on income - (10.16%)

- Additional network volume required to match the income in Epoch 11 - 1,125 - 2,812 BTC

- If fees are raised to 0.3%, the additional volume required to match Epoch 10 - 937 - 2,812 BTC

Hello Everyone!

I do not agree with raising or decreasing minting and burning fees right now. I think we should give it a few more epochs. Maybe 2-3 more to gather more data.

Everything is going as planned:

- Volume is picking up nicely

- We have 172 darknodes coming live this upcoming epoch.

- We have Ren Bridge 2.0 coming live by end of q1.

- Income has started increasing again. Last epoch was our lowest at 0.0145 BTC. This epoch we got a positive reversal in fee income with 0.0166 BTC

I am confused that some worry that TVL goes down. The incentives for REN are based 100% on darknode rewards, so rewards is ALL that counts. TVL is just a liability that earns us nothing. So I hope it is consensus that we need to maximise rewards: Volume*fee.

No-one really knows how higher or lower fees will affect volume. So we need to experiment until we see a significant impact. And then we need to go back and forth around the sweet spot to see if our experiment is reproducible. So far, increasing the fee was very successful and I don’t see why we should not continue the experiment as suggested in RIP 1:

To be sure that sweet spot is not a local maximum, I would throw in cheap discount epochs every now and then to check our assumptions.

I agree that BURN should also be experimented with, but we need to master MINT first. Doing both at the same time is a mess. I think it i also fair to let people out for cheap as long as we are still in the early stages.

Regarding use cases that are only viable with low fees: Is it possible to offer special rates to certain actors/addresses? Like whitelisting an arb bot, 1inch, 0cf… Maybe even discounts for an introduction period…

EDIT: I see such concepts are discussed here: RFC-000-014: Time-based burn (and thus total) fee

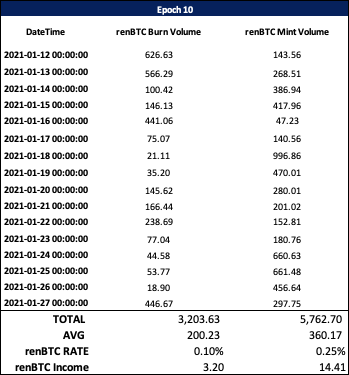

RFC MINT Update: 1/20/21

MINT volume this epoch is pacing at a higher rate than the previous epoch.

We are seeing lower BURN volumes as DEFI yield opportunities and industry momentum continues to rally off the lows of Epoch 8 and 9.

The income earned from MINTS is in far excess of BURNs, and REN has seen price appreciation that can largely be attributed to the fee increases passed resulting in higher income for Dark Node Operators.

Projecting out the rest of this epoch if average MINT / BURN volume continues at the current rates.

Projected MINT: 10,050 BTC @ 358 avg

Projected BURN: 7,041 BTC @ 251 avg

Projected MINT income: 25.13 BTC

Projected BURN income: 7.04 BTC

Projected per Node income: 0.0187 BTC

Annualized Node Income: 0.24BTC

Current REN Price: .00002 BTC

APY: ~12%

Projected Network Cost by not raising fee: 5 BTC

At $33,000 BTC this is roughly $160,000

Give it a rest already.

Why not increase fees to 20% since we will make loads more money, and of course raising fees never has any impact on volume levels…

There is a 40x difference between the proposed raise, and 20%. I think that in 12mo from now we will find that the ideal fee rate for RENbridge will land somewhere between 0.5% and 1% MINT and BURN, based on the yields earned in Defi this is not an unreasonable amount to charge to bring your collateral of choice into the lucrative DEFI space and keep it there.

That said, having flexible pricing is an RFC I proposed back when the forums first opened. It has been discussed that there could be high frequency integrations that might bring us strong volume that doesn’t make sense at higher fee rates, but so far they haven’t proven to be meaningful yet. This can be addressed with contract use case-specific pricing, but so far the data would suggest the inflows and outflows of DEFI are unphased by our fees.

Thus to benefit all dark node operators and the value of the network we should discover the fair price for our services, and this can be done simply by raising the fees. This includes raising the burn fees, which I will be putting an RFC for together before the end of the epoch.

As we have seen this epoch, MINTs volumes are much higher than BURN volumes, and our BURN fee rate is less than half than that of the MINT fee rate.

It is interesting that you stopped using TVL/TVB as an excuse for raising fees.

Not that long term effects of these proposals would have any impact on you since you do not have any nodes.

“The ideal fee rate for RENbridge will land somewhere between 0.5% and 1% MINT”

Do that and we are dead. Technology is primarily supposed to bring advantages and help lower costs. Any alternative that is developed in time to snatch a large share of the market will be happy to see this decision made.

We need to test how the integrations with renvm under the hood react to lower fees. They charge (I guess usually) + 0.10% and the cost gets higher than average:

LP Uniswap is 0.30%

Mint wbtc on bitgo 0.30%

Synthetix exchange 0.30%

-Let’s test lower fees away from the problem TVL / TVB. We really are not understanding how huge is the solution with Asylo. It’s a Before-after no doubt.

-Need to bring certainty of economic model. You are thinking as if you were inside a sect, and the only path that the insane economy of rising fees will take us is implosion when more alternatives appear.

REN has this unique opportunity being avant-garde with best technology, we just need to grow in liquidity. TBV, plus nodes, income, will come easily in this context.

It’s the Economy

Some in this thread seem to state that increasing our TVL is a goal in and of itself. That we should, in other words, strive to increase the number of renBTC on Ethereum.

I think it is worth noting that locking assets is NOT the goal of RenVM.

RenVM is an interoperability solution, not a custodial solution.

Taking assets in to custody and minting a wrapped representation is just a means to an end.

Our metric of success is not how many ren assets there are, or how many are locked in farming pools etc.

Our metric of success is volume.

We should prefer farms that lock wBTC (or any other asset/btc flavour) and provide a RenVM integration to do BTC -> renBTC -> wBTC -> farm

This drives volume because arbitrageurs with access to wBTC will burn back renBTC to balance the pools, as opposed to the renBTC being locked in the farm for long periods.

If integrators come to the network with proposals we need to ask them to SHOW US THE VOLUME, if it exceeds the current revenue we yield by having market-rate fees, then lets draft a time based smart contract with this integrator with specific conditions that can be measured per epoch, rules can be set if after 3 months of onboarding volume is unable to stabilize or grow fees it can be repegged to market rate fees.

If volume grows and more opportunity rates will hold at a discounted rate. In this High-Speed Integrator Rate Proposal agreement, the network is able to balance all of the network priorities, by introducing fee flexibility and an outline of criteria for success.

All data suggest that the volume has not outpaced our fee raises, thus the conclusion is and remains: raising fees was the correct decision for the network and has pushed the platform to where it is today, continued healthy growing of nodes, income, volume, and integrators.

One part worth mentioning, the more contentious the decisions get internally the higher the chances of people forking off. Look at the recent events with Curve and Saddlefinance. If the market perceives renVM fees too high there WILL be forks. Scammers are constantly lurking in the shadows in crypto, Cannon being a recent example of an attempt to fork Ren.

Short term boost in revenue and optimization of the economics is great and all, but lets also keep in mind what the long term objectives are. Where renVM ADDs value to the ecosystem and the rewards that come with are not the main driver, rather providing a robust and reliable infrastructure for interoperability. You might be right that there is an opportunity cost in not raising fees, but at the same time do you take user experience into consideration?

I dont see the rationale in increasing revenue at the cost of user experience. There should be a balance to not create non-existent bottle necks. Integrators, node operators and so on mean nothing without users.

RenVM is in a very early stage at the moment, with loads of updates that will build up trust in the network (eg. greycore expansion, sharding, Asylo). We dont know how those upgrades will affect volume, there are many factors that influence users and not only fees. The numbers seem to show a healthy growth now, why not sit back for a bit and see how the market develops? There is plenty of time to tinker with fees later, you wont find the ideal balance at such an early stage of the project.

If renVM charges 1% fees I would just buy WBTC on binance instead, there is no KYC needed there either as long as I dont withdraw more than 2 BTC per day. Thats just one example, as renVM grows in teh space there will be numerous competitiors who will undercut the fees if they are too high

I have never considered the TVL as the main metric but, firstly, a value that influences the volume of transactions, and because of the relationship with volume, the starting point for the progressive and chained increase of TVB, nodes, revenues . I know perfectly well that a TVL of 5B and a volume of 10 dollars is possible. But we all know that this is never going to happen as a rule. It is a showcase, a liquidity pool that will sooner or later be burned and ideally re-minted if the previous process was successful and inexpensive.

RenVM Network Status Update

BTC TVL has risen nearly ~3,000BTC+

MINT Volume is outpacing BURN volume 179%

MINT Income is pacing to hit a record for the RENVM network (thanks to fee raising RIPs)

BURN Volume despite having discounted fees is pacing at a level not seen since Epoch 7

Adding to this thread it appears frenbtc was dropped by harvest.finance. I follow it pretty close but didnt catch why or any comments, which to me seems obvious it was for fees.

wBTC has higher fees than renBTC.

I could be wrong i didnt actually hear why. I know they still have the renbtc crv strategy and theyre adding some klondike renbtc strategy off synthetix so maybe they just dropped outdated ones